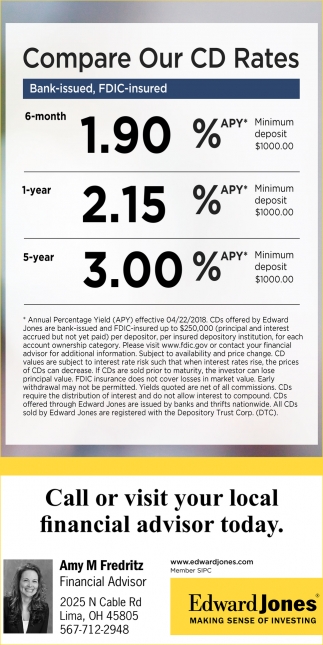

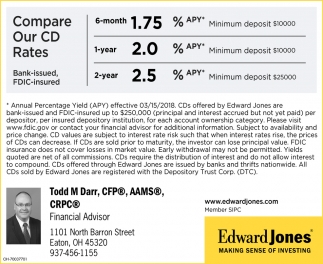

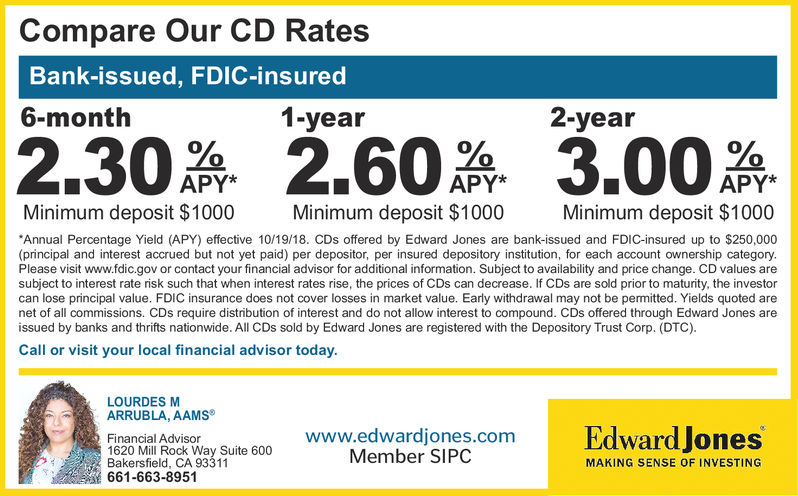

Edward Jones Cd Rates

- Find the best CD rates by comparing national and local rates. A Certificate of Deposit is a type of savings account that has a set interest rate and withdrawal date. Typically, CD interest rates.

- Best CD rates of March 2021. Bankrate has conducted market research on over 4,000 banks and credit unions nationwide to find accounts with the best CD rates. Here is Bankrate's list of top banks.

carVehicle Loan Rates

See full list on smartasset.com.

*Annual Percentage Rate. Rates available are subject to credit approval and subject to change without notice. Rates shown include the 1% buy-down program discount and no additional discount is available beyond these rates. Additional conditions may apply. Rates are effective as of 11/16/20.

| Amount Financed | Annual Percentage Rate (APR) |

|---|---|

| New / Used Vehicle - Terms 60 months or less | As low as 2.99% APR* |

| New / Used Vehicle - Terms 61 months or greater | As low as 2.99% APR* |

| New / Used Vehicle - 5 Year Balloon | As low as 7.74% APR* |

| New / Used Motorcycle | As low as 6.24% APR* |

| New / Used ATV / UTV | As low as 6.74% APR* |

| New / Used Boat / Jet Ski / RV | As low as 5.49% APR* |

creditcardCredit Cards

:format(jpeg):mode_rgb():quality(90)/discogs-images/A-294163-1260742711.jpeg.jpg)

*Annual Percentage Rate. Rates available subject to credit approval and subject to change without notice. Rates are effective as of 03/17/20. Application and Solicitation Disclosure (PDF)

| Card | Grace Period | Annual Fee | APR | |

|---|---|---|---|---|

| Visa Platinum | 5 Days | $0.00 | As low as Prime + 3.99% APR* | Currently: 7.24% APR* |

| Signature Card | 5 Days | $0.00 | As low as Prime + 6.49% APR* | Currently: 9.74% APR* |

Edward Jones Cd Rates Today

redirectLoans

*Annual Percentage Rate. Rates available subject to credit approval and subject to change without notice. **Home Equity Line of Credit rate is Prime minus 1% APR*, with a floor of 3.00% APR. Rates are effective as of 11/16/20.

| Loan Type | Annual Percentage Rate (APR) |

|---|---|

| First Mortgage | Home Mortgage Loans |

| Home Equity Loan | As low as 2.74% APR* |

| Home Equity Line Of Credit | As Low as Prime minus 1% APR**. Currently 3.00% APR* |

| Signature | |

| Unsecured | As low as 9.99% APR* |

| Holiday / Vacation | As low as 9.49% APR* |

| Overdraft Protection | As low as 9.49% APR* |

| Share Secured | |

| 100% Secured | As low as 2.05% APR* |

| 50% Secured | As low as 3.05% APR* |

| Certificate Secured | |

| 100% Secured | 2.00% APR* above the Share Certificate |

Best Cd Rates Edward Jones

newspaper Jumbo Share Certificate

*Annual Percentage Yield. Certificate subject to penalty for early withdrawal. Penalty is 90 days interest for terms up to 18 months. Penalty for terms two years or greater is 180 days interest. Rates available as of 8/21/2020 and are subject to change.

CD Rates Disclosure (PDF)

| Period | Minimum Balance | Dividend Payment | Dividend Rate | APY |

|---|---|---|---|---|

| 1 Year | $100,000.00 | Monthly | .65% | .65% |

| 1 Year | $100,000.00 | At Maturity | .65% | .65% |

| 18 Months | $100,000.00 | Monthly | .75% | .75% |

| 18 Months | $100,000.00 | Annually | .75% | .75% |

| 2 Year | $100,000.00 | Monthly | .85% | .85% |

| 2 Year | $100,000.00 | Annually | .85% | .85% |

| 3 Year | $100,000.00 | Monthly | 0.95% | 0.95% |

| 3 Year | $100,000.00 | Annually | 0.95% | 0.95% |

| 4 Year | $100,000.00 | Monthly | 1.05% | 1.05% |

| 4 Year | $100,000.00 | Annually | 1.05% | 1.05% |

| 5 Year | $100,000.00 | Monthly | 1.14% | 1.14% |

| 5 Year | $100,000.00 | Annually | 1.14% | 1.15% |

charts IRA Share Certificate

*Rates available as of 8/21/2020 and are subject to change. Certificate subject to penalty for early withdrawal. Penalty is 90 days interest for terms up to 18 months. Penalty for terms two years or greater is 180 days interest. CD Rates Disclosure (PDF).

| Period | Minimum Balance | Dividend Payment | Dividend Rate | APY |

|---|---|---|---|---|

| 1 Year | $1000.00 | At Maturity | .60% | .60% |

| 18 Months | $1000.00 | Annually | .70% | .70% |

| 2 Year | $1000.00 | Annually | .80% | .80% |

| 3 Year | $1000.00 | Annually | .90% | .90% |

| 4 Year | $1000.00 | Annually | 1.00% | 1.00% |

| 5 Year | $1000.00 | Annually | 1.09% | 1.10% |

moneybag Savings Account

*Annual Percentage Yield. Rates available as of 3/1/21 and are subject to change.

Truth in Savings Disclosure (PDF)

| Account Type | Minimum Balance to earn Dividends | Dividend Period | Dividend Rate | APY |

|---|---|---|---|---|

| Senior Share | $100.00 | Monthly | .10% | .10% |

| Club Accounts | $.01 | Monthly | .10% | .10% |

| IRA Accounts | $.01 | Monthly | .10% | .10% |

| Prime Share | $100.00 | Monthly | .05% | .05% |

analyticsMoney Market Accounts

*Annual Percentage Yield. Rates available as of 3/01/21 and are subject to change.

Truth in Savings Disclosure (PDF)

| Minimum Balance to earn Dividends | Dividend Period | Dividend Rate | APY |

|---|---|---|---|

| $1,000 - $9,999.99 | Monthly | .20% | .20% |

| $10,000 - $24,999.99 | Monthly | .20% | .20% |

| $25,000 - $49,999.99 | Monthly | .30% | .30% |

| $50,000 + | Monthly | .35% | .35% |

percent Step Rate Share Certificate

*Annual Percentage Yield. Certificate subject to penalty for early withdrawal. Penalty for terms two years or greater is 180 days interest. Rates available as of 8/21/20 and are subject to change.

CD Rates Disclosure (PDF)

| Period | Minimum Balance | Dividend Payment | Dividend Rate | APY |

|---|---|---|---|---|

| 2 Year | $1000.00 | Monthly | .70% | .70% |

| 2 Year | $1000.00 | Annually | .70% | .70% |

newspaper Regular Share Certificate

*Annual Percentage Yield. Certificate subject to penalty for early withdrawal. Penalty is 90 days interest for terms up to 18 months. Penalty for terms two years or greater is 180 days interest. Rates available as of 8/21/2020 and are subject to change.

CD Rates Disclosure (PDF)

| Period | Minimum Balance | Dividend Payment | Dividend Rate | APY |

|---|---|---|---|---|

| 3 Months | $1000.00 | At Maturity | .30% | .30% |

| 6 Months | $1000.00 | At Maturity | .40% | .40% |

| 1 Year | $1000.00 | Monthly | .60% | .60% |

| 1 Year | $1000.00 | At Maturity | .60% | .60% |

| 18 Months | $1000.00 | Monthly | .70% | .70% |

| 18 Months | $1000.00 | Annually | .70% | .70% |

| 2 Year | $1000.00 | Monthly | .80% | .80% |

| 2 Year | $1000.00 | Annually | .80% | .80% |

| 3 Year | $1000.00 | Monthly | .90% | .90% |

| 3 Year | $1000.00 | Annually | .90% | .90% |

| 4 Year | $1000.00 | Monthly | 1.00% | 1.00% |

| 4 Year | $1000.00 | Annually | 1.00% | 1.00% |

| 5 Year | $1000.00 | Monthly | 1.09% | 1.09% |

| 5 Year | $1000.00 | Annually | 1.09% | 1.10% |

The Annuity Man® has developed a proprietary tool that allows you to shop for the best MYGA rates in the country and your specific state of residence.

With our live feed of the best MYGA rates, you can now shop for annuities online to find the best annuity rate that fits your financial situation and goals before you decide to purchase an annuity.

Multi-Year Guarantee Annuities (MYGAs) are also called fixed-rate annuities and are a specific annuity product type that functions similarly to a CD (Certificate of Deposit).

Both MYGAs and CDs contractually guarantee an annual interest rate for a specified period, have no annual fees and are fully principal protected.

Some of the key features and benefits that MYGAs contractually offer are listed below.

- No annual fees

- Contractually guaranteed annual interest rate

- Tax-deferred growth in non-IRA accounts

- Rates are typically higher than CDs

- Interest compounds tax-deferred in a non-IRA account

- Can be purchased inside of an IRA or non-IRA account

- Easy to understand

- No moving parts or market attachments

- Can be laddered like CDs and Bonds

- Full principal protection

- Can be transferred to another MYGA without tax consequences

Multi-Year Guarantee Annuities (MYGAs) are the annuity industry’s version of a CD (Certificate of Deposit). Both MYGAs and CDs allow you to contractually lock in a specific annual interest rate for a duration of time you choose at the time of application. MYGAs can be as short term as 2 years and you can lock them in for as long as 20 years. MYGAs have no annual fees, no moving parts, and provide full principal protection while guaranteeing an annual interest rate. If you are a current CD buyer, then you should also be a MYGA buyer.

The primary difference between a MYGA (i.e. annuity contract) and a CD is that in a non-IRA (i.e. non-qualified) account, the MYGA interest grows tax-deferred with no tax penalty on the interest earned. With CDs in a non-IRA account, you must pay taxes annually on that guaranteed interest rate that is credited. This tax-deferral benefit does not make MYGAs better than CDs, it is just the primary contractual difference between the two strategies. MYGAs can also be transferred from one MYGA to another in a non-IRA account, without creating any tax consequences. In other words, that annuity to annuity transfer would be a non-taxable event using the IRS approved 1035 exchange rule. MYGAs inside of an IRA can also be transferred via a non-taxable event as well. That would be an IRA to IRA transfer and would not trigger any taxes.

After the surrender charge period ends, you can also transfer a MYGA to another type of annuity as well. For example, you can transfer the full MYGA proceeds to a SPIA (Single Premium Immediate Annuity) if you need income to start now. Another example would be to transfer your MYGA to a DIA (Deferred Income Annuity) if you need income guarantees to start at a future date. In each case, the initial cost basis would transfer to the receiving annuity strategy...and that transfer would be a non-taxable event as well.

The other difference between MYGAs and CDs is the backing or insurance behind the product. MYGAs are fixed annuities that are issued by life insurance companies and regulated at the state level. Each state has its own State Guaranty Fund that backs MYGAs to a specific dollar amount. Each state has different coverage, so go to www.nolhga.com to check your specific state of residence coverage. CDs are FDIC insured. The Federal Deposit Insurance Corporation (FDIC) is superior coverage, in my opinion, when compared to State Guaranty Funds.

MYGAs and CDs can work well together to create a fixed rate ladder strategy. Historically, we have found that MYGAs provide higher rates than CDs if the contracted term is 3 years or more. For less than 3-year time periods, CDs typically provide the highest annual rates. With most MYGAs, you can choose to peel off the interest penalty-free. Peeling off the interest is not considered “partial withdrawals” because the principal is never touched. If you do decide to dip into the principal, there will be surrender charges during the specific locked-in period. This interest only strategy can be part of your retirement income plan, in combination with Social Security, pensions, etc.

MYGAs can be set up with one owner, or with joint ownership. Also, the listed beneficiaries on the policy can be changed by the owner(s) at any time as long as they are alive. In other words, your policy beneficiaries are revocable...not irrevocable. That is important if your beneficiary listings need to be changed or updated.

If you are a current CD buyer, then you need to consider adding MYGAs to your principal protected fixed-rate portfolio. It is important to consider the MYGA company’s claims-paying ability before making your final decision. On our site, we offer a free download of a monthly CANNEX report that shows all 4 rating services (A.M. Best, Moody’s, S&P, Fitch) and an easy to understand 1 to 100 score for each life insurance company (i.e. MYGA carrier) in the United States.

Before you purchase a MYGA, you need to read my MYGA Owner’s Manual and speak with me personally before you make a decision. We have a live feed of the best MYGA rates that you can look at and shop around without having to sign up. Most MYGAs allow you to peel off the interest penalty-free, but not ALL do. On our live feed, we will show you the MYGA carriers that allow or do not allow interest to be taken out. I encourage you to take a look at the best rates and terms for your state of residence and then schedule a call with Stan The Annuity Man® to have a full conversation about MYGAs.

Edward Jones Cd Rates Highest

There is never an urgency to buy a MYGA (or any annuity for that matter), the only urgency is to fully understand the benefits and limitations of the MYGA you are specifically considering.