Dbs Savings Account

My Account for your child. For existing POSB/DBS account holders, you can apply for a joint alternate My Account with your child online. Applicable to children below 16 years old, and do not own an existing joint alternate My Account. Please prepare the following. A DBS Treasures premium savings account is for those who want to turn routine banking into a long-standing relationship with a host of exclusive lifestyle and banking privileges: Family Privileges. With a premium savings account, you and your loved ones get exclusive access to a range of lifestyle privileges. Make every day easier with DBS PayLah! Get rides, book tickets, order meals, find your favourite DBS/POSB card rewards! Multiplying is easier for everyone now. With no minimum amount required, DBS Multiplier leaves no bunny behind. If your My Account/ multi-currency account is linked as the primary account to your DBS Visa Debit Card, foreign currency purchases made online and overseas will automatically be debited from your account’s respective foreign currency funds at no foreign exchange conversion fees. This applies to overseas ATM withdrawals as well. Multiplying is easier for everyone now. With no minimum amount required, DBS Multiplier leaves no bunny behind. Take care of your baby’s future. Starting with their first bank account. May the huat be with you this new year.

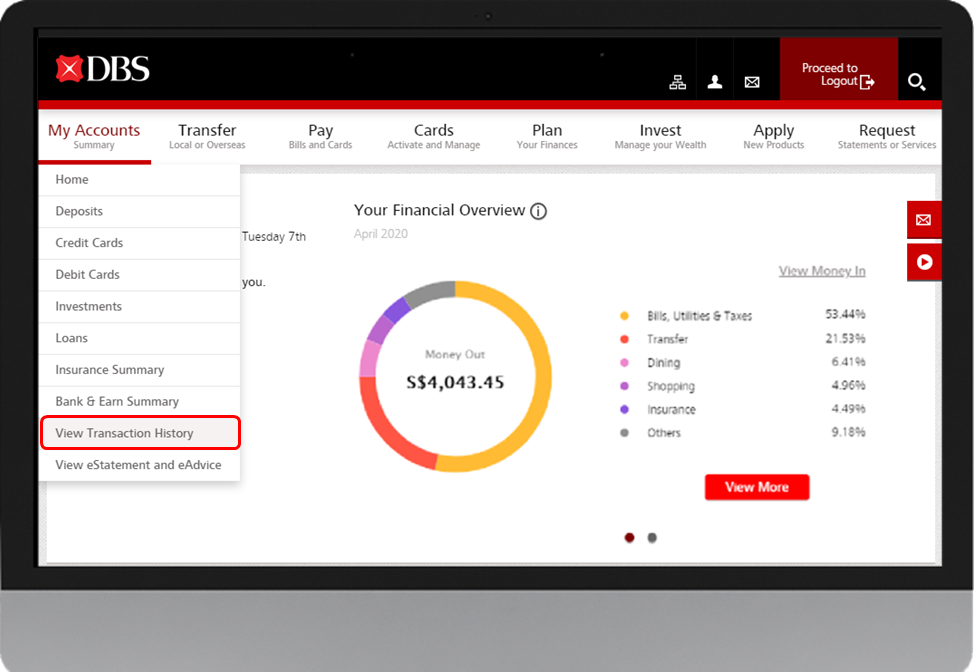

At a Glance

You need flexible, convenient and instant deposit and withdrawal services to meet your daily needs. DBS has several RMB savings accounts to choose from. Find the one that’s just right for you. ;;;

1. RMB savings accounts

Account types | Benefits | Minimum balance requirement |

|---|---|---|

RMB personal settlement account* |

| CNY1 |

RMB remittance savings account (Limited to residents of Hong Kong SAR) |

| CNY1 |

RMB remittance savings account-Self Name/Third Party (Limited to residents of Taiwan Region) |

| CNY1 |

2. Foreign currency savings account*

- Choose from 10 currencies: USD, HKD, JPY, EUR, AUD, CAD, GBP, SGD, CHF and NZD

- USD and HKD cash services

- AUD and SGD cash services (only available at selected branches)

- Flexibility and convenience with no minimum balance requirement

* This account is only available for clients who are 18 years or older. For customers who are younger than 18 years old and wish to open the Account, a Minor Trust account or Minor Non-Trust account may be opened in the company of his/her statutory agent.

For CNY cash withdrawal amount of ≥ CNY 50,000, or foreign currency amount ≥ USD/HKD/AUD/SGD 5,000 (in Shenzhen area, for any AUD/SGD cash withdrawal, USD cash withdrawal amount of ≥ USD 1,000, or HKD cash withdrawal amount of ≥ HKD 10,000), please raise a request through the branch or your relationship manager before 12 noon, one working day in advance.

How to Apply

Visit any of our branches

Call our DBS 24-hour personal banking hotline at 400 820 8988

Dbs Savings Account Interest Rate Singapore

Useful Links