Chime Deposit

Jan 22, 2021 The Chime Credit Builder Visa® Secured Credit Card has no annual fee, no interest charges, no minimum security deposit and no credit check when you apply. These features put the Chime Credit Builder Visa® Secured Credit Card in a small but growing family of cards that focus on consumer-friendliness first and foremost – the Petal lineup of. To make direct deposits through your employer or payroll provider, provide them with your Chime routing number and Spending Account number. Chime takes care of the rest. Your funds will automatically post to your Chime.

Get your paycheck up to two days early¹

Get your paycheck early¹ with direct deposit. That’s up to two more days to do more with your money. Stop waiting and start getting paid early!

Chime Deposit Account

Learn how we collect and use your information by visiting our Privacy Policy›

The Bancorp Bank or Stride Bank, N.A.; Members FDIC

Don’t wait for your paycheck

When you receive direct deposit to your Online Chime Spending Account, you can access your funds up to two days early¹. No waiting for your money, and no paper check to get lost in the mail. You’ll get paid as soon as the money is available – which is often up to two days before traditional banks.

How to get paid early with direct deposit

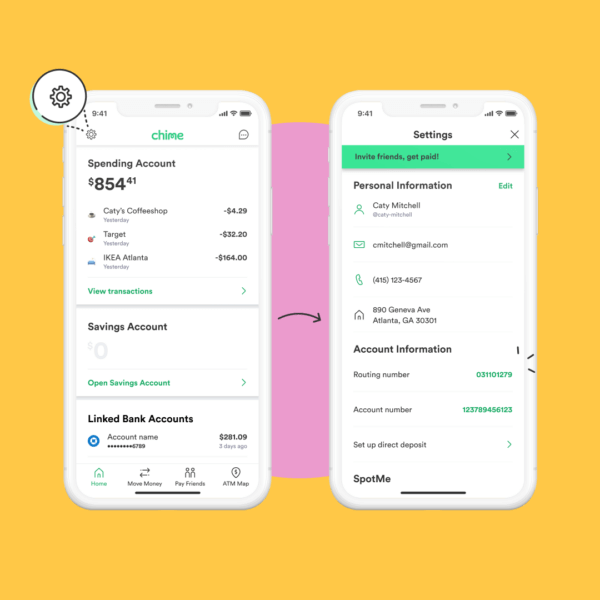

Chime is more than a get paid early app. We offer a mobile banking account – including early direct deposit¹ – on behalf of our partners. One of the easiest ways to fund your Chime Spending Account is to set up direct deposit, which can be done in the Chime mobile app. When you open an account through Chime, you can email yourself a pre-filled direct deposit form that you can hand over to your employer. It’s that easy to start getting paid early¹ with direct deposit.

Check My Chime Card Balance

2 minutes with no impact to your credit score.

Chime Deposit Account

Learn how we collect and use your information by visiting our Privacy Policy›